PERRY, Fla. – Ron Elrod and his family of four, plus two cats and a dog named Buddy, huddled inside a friend’s garage as the full fury of Hurricane Idalia made landfall Wednesday just a few miles away. The walls bulged as the winds outside roared.

Elrod and family took shelter there over concerns the trailer where they lived at the Coastal River RV Resort in nearby Steinhatchee might not survive what came ashore as a strong Category 3 hurricane. Flooding from the powerful storm surge there was catastrophic.

“I don’t ever want to go through that again,” said Elrod, 38. “When you see the walls on the building that you’re in move, it makes you wonder whether you made the right decision to evacuate. But I’m glad we left.”

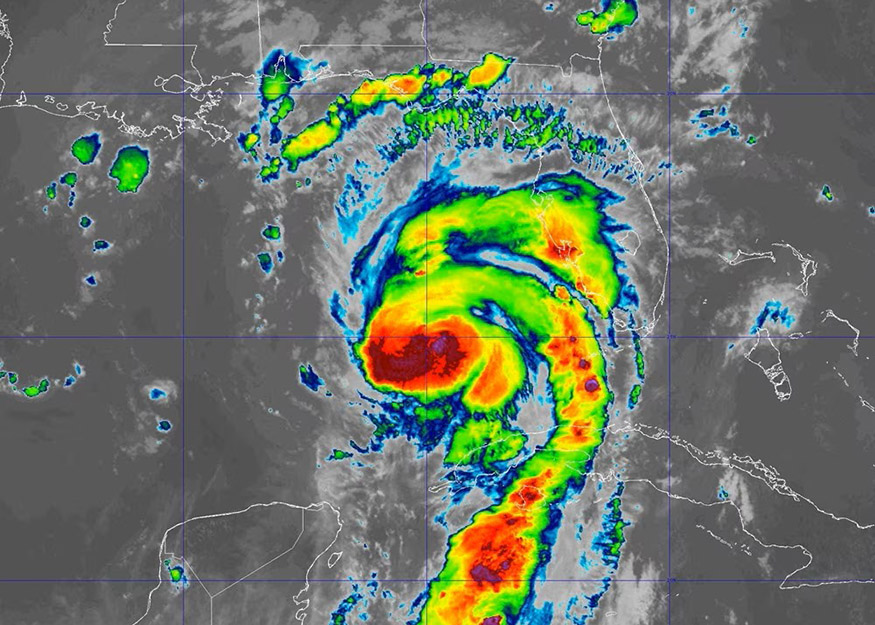

Along Florida’s Big Bend – the peninsular arch along the Gulf of Mexico – survivors of the dangerous storm emerged Wednesday in the daylight to take stock of their losses. The hurricane struck one of the state’s least populous regions, but people who make their living and reside in the shadow of Apalachee Bay faced ruin from seawater that surged as much as 15 feet and winds that exceeded 125 mph.

Gov. Ron DeSantis, who paused his political campaign for the Republican presidential nomination to stay in Florida during the storm, promised help was available. Authorities rescued 40 people from flooded and destroyed homes, he said. More than 146,000 remained without power early Thursday, the governor said. Crews reopened highways blocked by debris, including a 15-mile stretch of Interstate 10 in Madison County. The main bridge connecting the Cedar Key fishing village to the mainland was back open. State and federal agencies were working, he said.

DeSantis said students were back in classrooms Thursday in 32 of the 52 public school districts that had closed. The University of Florida, about 80 miles east of where the hurricane made landfall, resumed classes Thursday. Florida State University, about 70 miles northwest of where the storm came ashore, canceled classes through Friday.

“The community is resilient, and we are going to work hard to make sure they get what they need,” DeSantis said Thursday.

Elrod works in a hardware store in the coastal town of Steinhatchee, where flooding was merciless along the Steinhatchee River. His trailer survived, he said. The family had evacuated a day earlier to Perry, about 20 miles away. Local police and state troopers blocked entry to Perry, saying the area was too dangerous for anyone other than locals to approach.

Elrod’s coworkers, family and friends live there. Many didn’t evacuate, he said.

“A lot of our people in Steinhatchee weren’t as lucky as us. Some told me they saw houses floated out of the river mouth,” he said. He added that he expected to head there Thursday “to help people anyway we can.”

Florida Highway 51, a north-south road that snakes from Steinhatchee inland toward the town of Live Oak, was a corridor of carnage. Hurricane Idalia left in its path uprooted, gnarly trees slumped over fallen power lines. Darkened traffic lights hung in flooded intersections. First responders raced down the highway toward the coast.

There had not been a storm of this magnitude in this region of Florida in modern times, but Jim Hooten, 49, of Steinhatchee said he knew right away how to help. Hooten and his family run ASAP Tree and Fence LLC, and were on the scene to clear the roads for the residents of Steinhatchee – for free.

“We’re going to take care of all our locals for sure, whether we lose money or not,” Hooten said. “We’ll be here all night, and tomorrow, we’re going into town to help the poor folks.”

Hooten, his family and workers traveled Highway 51 in a caravan of three SUVs and two cherrypickers. When they encountered an obstruction, the men would hop out of their vehicles, disassemble the felled limbs, pack up their chainsaws and move on. A young child slept in Hooten’s passenger seat.

“I’ve seen all kinds of stuff – Andrew and Ida – this ain’t nothing,” he said.

Along U.S. Highway 98, which tracks the Florida coastline along the Gulf, pine trees lay snapped, keeled over in rows – the pine smell a pungent testament to the disfigured landscape. At the municipal airport in Perry, the storm’s winds had flipped a single-engine plane upside down on the runway, its final flight powered by the hurricane’s gusts.

The airport manager, Ward Ketring, who slept alone in his office Tuesday night, said the plane was destroyed beyond repair.

“I'm almost 60 years old. I've never seen anything close to this,” Ketring said. “The devastation is just overwhelming.”

Ketring hadn’t yet returned to his home in Perry. He didn’t know what he might find, just that he was the only one to care for 12 planes still stashed away safely at the airport.

In Perry, storefronts were torn off their foundations. Roofs were peeled back. Downed power lines pooled in the streets and a gas station awning lay sideways.

Trucks churned up and down the main road towing trailers of debris and returning with empty beds and hitches for more. First responders, tree services and caring neighbors busied the streets without much conversation. Witnesses stood with their hands on their hips, with blank stares toward their ravaged properties.

Dallis Jenkins, 84, lives off Puckett Road in Perry, and he said he didn’t just endure the wrath of Idalia but related tropical tornadoes, too. The bumper of his car sagged to the pavement and the metal shingles of the roof of his home were rolled up, exposing the wooden foundation beneath.

“I’m a veteran, and when that tornado came through, it sounded just like a bomb went off,” Jenkins said.

He chatted with his neighbors on his lawn while a roofer gauged the damage. During the storm, water seeped under the door, flooding the inside of Jenkins’ house and fell through the damaged ceiling.

Jenkins and his wife have homeowners’ insurance, but as they get older, Jenkins said he can hardly muster the energy to tackle the required renovations.

“I'm too weak to do anything,” he said. “I can’t even breathe anymore.”

Atop Jenkins’ roof was Jimmy Wilson, who descended the ladder with an assessment: Whole parts of the roof were missing. The damage was severe.

Wilson made the drive from his home in Panama City, where he lost his house four years ago in Hurricane Michael. When he heard Idalia was charging for Perry, he knew where he was needed.

“My buddies told me, ‘You’re going to scratch up your truck working down there,’ and I said ‘I ain’t worried about the truck, I know what these people are going through,’” Wilson said.

He also came into town with a truck of tarps and ice for the many without power.

Jenkins and his wife said they have never experienced a storm like this, and they aren’t sure when the house will be fixed or when power will return.

Despite the damage, people streamed in after the hurricane to help. Neighbors checked on each other. Police officers, firefighters and Coast Guard crews filled in where needed.

Now would begin the lengthy period of rebuilding.

And as he started his generator in the RV park, Elrod and his family were pleased to be alive.

“Don't forget about small towns,” Elrod said. “Steinhatchee is a really nice place, and there's a lot of good people down there. Just because we may not bring in all the money like the bigger cities, doesn’t mean you can forget about us.”

# # #

Email editor@

alachuatoday.com